Audited financial statements are verified documents reviewed by certified public accountants to ensure accuracy and compliance with accounting standards, providing a true and fair view of a company’s financial position and performance.

What Are Audited Financial Statements?

Audited financial statements are documents verified by certified public accountants (CPAs) to ensure compliance with accounting standards. They include balance sheets, income statements, cash flow statements, and notes to the financial statements, providing stakeholders with an accurate and unbiased view of a company’s financial position, performance, and cash flows over a specific period.

The Importance of Audited Financial Statements in Business

Audited financial statements are crucial for building credibility and trust with stakeholders, including investors and creditors. They provide assurance that financial data is accurate and compliant with standards, enhancing transparency and accountability. This trust is essential for securing investments, loans, and maintaining good business relationships, ultimately contributing to the company’s stability and growth.

The Auditing Process

The auditing process involves verifying financial data, evaluating internal controls, and ensuring compliance with accounting standards to provide an independent opinion on the financial statements’ accuracy.

Steps Involved in Auditing Financial Statements

The auditing process includes planning, risk assessment, evaluating internal controls, verifying financial data, reviewing adjustments, preparing statements, and issuing reports. It ensures compliance with standards and addresses challenges like COVID-19 impacts, providing a reliable opinion on financial accuracy.

The Role of Independent Auditors

Independent auditors analyze financial statements to ensure adherence to accounting standards, providing an unbiased opinion. They verify accuracy, assess risks, and evaluate internal controls, offering stakeholders confidence in the financial information’s reliability and transparency, crucial for informed decision-making and compliance with regulatory requirements.

Components of Audited Financial Statements

Audited financial statements include the balance sheet, income statement, cash flow statement, and notes, providing a comprehensive view of a company’s financial position, performance, and cash flows.

Balance Sheet

The balance sheet presents a company’s financial position at a specific point in time, detailing assets, liabilities, and equity. It provides insights into the company’s resources, obligations, and ownership stakes, ensuring transparency and accountability in financial reporting, as seen in audited financial statements sample PDFs.

Income Statement

The income statement, or profit and loss statement, outlines a company’s revenues, expenses, and net income over a specific period. It reflects operational performance, helping stakeholders assess profitability and financial health, as demonstrated in audited financial statements sample PDFs, ensuring compliance with accounting standards for accurate reporting.

Cash Flow Statement

The cash flow statement details cash inflows and outflows from operating, investing, and financing activities over a reporting period. It provides insights into a company’s liquidity and solvency, as seen in audited financial statements sample PDFs, ensuring transparency and compliance with accounting standards for comprehensive financial analysis.

Notes to the Financial Statements

Notes to the financial statements provide detailed explanations and disclosures, enhancing transparency. They include accounting policies, potential liabilities, and contingencies, as seen in sample PDFs. These notes ensure clarity on complex transactions, enabling stakeholders to understand the financial statements fully and make informed decisions, aligning with auditing standards for accuracy and completeness.

Types of Audit Reports

Audit reports include unqualified, qualified, adverse, and disclaimer opinions, each providing varying levels of assurance on financial statements, as detailed in sample PDFs, ensuring compliance and transparency.

Unqualified Audit Report

An unqualified audit report indicates the financial statements present a true and fair view, with no material misstatements, providing stakeholders with high assurance of accuracy and compliance with accounting standards, as seen in sample PDFs.

Qualified Audit Report

A qualified audit report indicates the financial statements are accurate except for specific issues, such as scope limitations or non-compliance with accounting standards. It provides reasonable assurance but highlights exceptions, ensuring stakeholders are aware of potential risks, as seen in sample PDFs of audited financial statements.

Adverse Audit Report

An adverse audit report is issued when financial statements do not accurately represent a company’s financial position due to significant departures from accounting standards or misleading information. This report undermines credibility and trust, as highlighted in audited financial statement samples, signaling substantial risks to stakeholders and regulatory concerns.

A disclaimer of opinion occurs when an auditor cannot form an opinion on a company’s financial statements, often due to insufficient evidence or lack of independence. This is reflected in sample audited financial statement PDFs, indicating significant uncertainties and limiting the report’s reliability for stakeholders, as noted in various financial reporting guidelines.

How to Prepare Audited Financial Statements

Preparing audited financial statements involves data collection, adjusting journal entries, and preparing the trial balance. Ensure compliance with accounting standards for accurate reporting.

Data Collection and Documentation

Data collection involves gathering financial records, invoices, and bank statements. Proper documentation ensures accuracy and compliance with accounting standards. Organize data chronologically, including COVID-19 impacts, to facilitate adjustments and ensure financial statements reflect the true financial position and performance of the entity.

Adjusting Journal Entries

Adjusting journal entries correct preliminary balances, ensuring accurate financial statements. These entries account for accruals, prepayments, depreciation, and bad debts. They reflect true financial performance and position, aligning with accounting standards and facilitating a smooth audit process for the preparation of audited financial statements.

Preparing the Trial Balance

Preparing the trial balance involves listing all general ledger accounts and their balances after adjusting entries. This step ensures all transactions are accounted for, helping detect errors and ensuring accurate financial statements. The trial balance is crucial for preparing audited financial statements, as it verifies the integrity of financial data before final reporting.

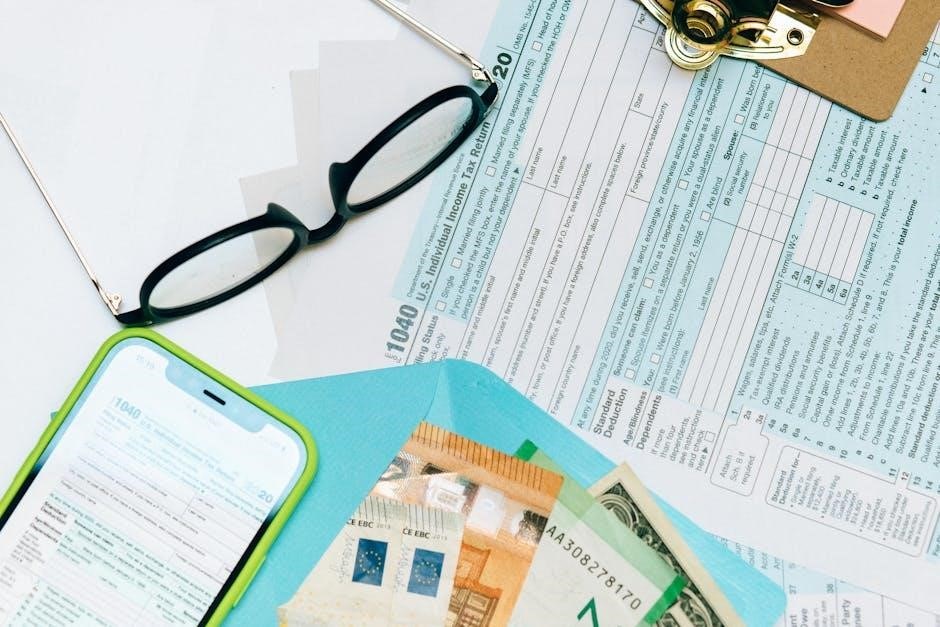

Sample PDF of Audited Financial Statements

Sample PDFs of audited financial statements are available online, offering exact copies of printed reports. Visit Grant Thornton’s website for detailed examples, including balance sheets and income statements.

Where to Find Sample Audited Financial Statements

Sample audited financial statements can be found on websites like Grant Thornton, official company websites, or regulatory platforms like the SEC’s EDGAR database. Professional accounting firms such as PwC or Deloitte also provide downloadable templates and examples for reference, ensuring access to accurate and standardized financial reporting formats.

Key Features of a Sample Audited Financial Statement PDF

A sample audited financial statement PDF typically includes a balance sheet, income statement, cash flow statement, and notes to the financial statements. It also features an auditor’s report, ensuring compliance with accounting standards like IFRS. The document is formatted to maintain readability, with clear headings and visual separation of sections for easy comprehension.

Benefits of Audited Financial Statements

Audited financial statements enhance credibility and trust, providing stakeholders with assurance of accuracy and compliance. They offer a true and fair view of a company’s financial health, aiding informed decision-making for investors and creditors.

Building Credibility and Trust

Audited financial statements enhance credibility by providing an independent verification of a company’s financial health. This assures stakeholders, such as investors and creditors, of the accuracy and transparency of the information, fostering trust and confidence in the organization’s financial reporting practices and decision-making processes.

Improving Transparency and Accountability

Audited financial statements enhance transparency by providing a clear and accurate representation of a company’s financial position and performance. This accountability ensures stakeholders, including investors and regulators, can rely on the information, promoting ethical business practices and compliance with financial standards, thereby strengthening corporate governance and public trust.

Challenges in Preparing Audited Financial Statements

Preparing audited financial statements involves challenges like COVID-19 impacts on reporting, ensuring compliance with IFRS and local GAAP, and addressing materiality concerns accurately.

Materiality and Its Impact

Materiality significantly influences financial reporting, as it determines whether certain information is substantial enough to impact decisions. Auditors must identify material errors or omissions, ensuring statements reflect a true and fair view. Misjudging materiality can lead to misleading financial positions or performances, affecting stakeholder trust and compliance with accounting standards.

Navigating COVID-19 Impacts on Financial Reporting

The COVID-19 pandemic introduced significant challenges in financial reporting, requiring preparers to consider how and where to disclose pandemic-related impacts under existing IFRS standards. Companies must address revenue declines, expense increases, and asset impairments while ensuring compliance and transparency. Clear reporting of these factors is crucial for maintaining stakeholder trust and meeting regulatory expectations.

The Role of Auditors in Financial Statement Preparation

Auditors play a crucial role in ensuring financial statements comply with accounting standards, verifying accuracy, and providing assurance that the statements fairly represent the company’s financial position.

Internal vs. External Auditors

Internal auditors focus on evaluating internal controls and operational efficiency, while external auditors provide independent verification of financial statements, ensuring compliance with accounting standards and offering an unbiased opinion on the accuracy of the financial data presented.

Responsibilities of Auditors

Auditors are responsible for examining financial records to ensure accuracy and compliance with accounting standards. They assess internal controls, test transactions, and evaluate financial statements to form an opinion on their fairness and reliability, providing stakeholders with assurance of the integrity of the financial data presented.

Regulatory Requirements for Audited Financial Statements

Regulatory requirements ensure audited financial statements comply with standards like IFRS and local GAAP. Audits provide assurance, building stakeholder trust and ensuring transparency and accountability.

Compliance with Accounting Standards

Compliance with accounting standards like IFRS and GAAP ensures consistency and accuracy in financial reporting. Audited statements must adhere to these standards, providing stakeholders with reliable data to assess financial performance and position. This compliance builds credibility and trust, aligning with regulatory requirements and enhancing transparency.

IFRS and Local GAAP Requirements

IFRS and local GAAP requirements are critical frameworks for preparing audited financial statements. IFRS provides global consistency, while local GAAP addresses specific regional regulations. Compliance with both ensures accurate reporting, meeting stakeholder expectations and legal obligations. This dual adherence enhances transparency and comparability of financial data across jurisdictions.

Common Mistakes to Avoid

Common mistakes include misjudging materiality, failing to account for COVID-19 impacts, and neglecting contingent liabilities, which can lead to inaccurate financial reporting and audit issues.

Errors in Financial Reporting

Common errors include misclassifying assets, incorrect revenue recognition, and improper accounting for liabilities. These mistakes can lead to material misstatements, requiring restatements and undermining stakeholder confidence. Auditors must carefully review financial records to detect and correct such errors, ensuring compliance with accounting standards and accurate financial representation.

Neglecting Contingent Liabilities

Overlooking contingent liabilities, such as pending lawsuits or warranties, can significantly impact financial statements. Failing to disclose or account for these liabilities may mislead stakeholders about a company’s financial health, leading to potential legal and reputational risks. Auditors must ensure these items are properly identified, measured, and reported to maintain transparency and compliance.

Best Practices for Audited Financial Statements

Adhering to accounting standards, ensuring accuracy, and maintaining transparency are essential. Continuous improvement in processes and documentation enhances reliability and stakeholder confidence in the financial statements.

Ensuring Accuracy and Completeness

Accurate and complete financial statements require rigorous data collection, proper documentation, and adherence to accounting standards. Verifying transactions, reconciling accounts, and addressing discrepancies ensure reliability. Auditors play a crucial role in detecting errors and confirming compliance, ultimately enhancing the credibility of the audited financial statements for stakeholders.

Continuous Improvement in Financial Reporting

Continuous improvement involves regularly reviewing and refining financial reporting processes to enhance accuracy and transparency. This includes adopting new accounting standards, leveraging technology for better data analysis, and ensuring compliance with evolving regulatory requirements. Regular audits and feedback loops help identify areas for enhancement, fostering trust and reliability in financial disclosures.

Audited financial statements play a crucial role in ensuring transparency, credibility, and compliance. They provide stakeholders with reliable insights, fostering trust and informed decision-making, while adapting to future trends and standards.

Audited financial statements provide a verified and transparent view of a company’s financial health, ensuring compliance with accounting standards. They include balance sheets, income statements, and cash flow statements, reviewed by independent auditors to build credibility. Key points highlight the importance of accuracy, compliance, and the role of auditors in maintaining stakeholder trust and accountability.

Future Trends in Audited Financial Statements

Future trends include digitalization, AI-driven audits, and blockchain integration for enhanced transparency. These technologies aim to improve accuracy, reduce costs, and provide real-time insights. Additionally, sustainability reporting and ESG factors are becoming integral, aligning financial statements with global environmental and social governance standards, ensuring comprehensive and forward-looking financial disclosures for stakeholders.